Corporate Governance & Compliance

Corporate Governance

Introduces the management setup and corporate governance of Nidec Group.

Codified in May 2006

Revised in July 2023

Nidec and its subsidiaries (the "Group") pursue continuous enhancement of corporate management in the manner consistent with our mission statement, basic management creed, and our qualitative objectives of achieving "high business growth," "high profits," and "high shareholder value."

In this context, we codified our corporate governance policies in May 2006 to reinforce the Group's overall corporate governance activities and communicate our commitment and responsibilities to stakeholders.

July 4, 2023 Corporate Governance Report(715KB)

Nidec Group Corporate Governance Policy

Principle

The Nidec Group Corporate Governance Policy aims for sustainable enhancement of corporate value based on ethical integrity and social trust. To this end, we pursue sound, efficient and transparent business management through ceaseless improvement in internal controls and information disclosure.

Stakeholder Engagement

Sustainable enhancement of corporate value builds upon harmonious relations with stakeholders. Our definition of stakeholders extends broadly and includes not only our shareholders, customers, suppliers, individual employees, but even the communities and the environment that can be directly or indirectly affected by the Group's objectives and actions. As a business seeking growth through fulfillment of social responsibility and sustainable corporate value development for our stakeholders, we will continue to increase our focus on products and activities that are green and socially desirable. This concept constitutes a common thread running through our entire business activities, most notably reflected in our engagement in the brushless DC motor technology, which provides excellence in energy efficiency, operating life and noiselessness for IT and audiovisual devices, automobiles, home appliances and industrial machinery. Nidec Group contributes to the progress of society and reduction of load on the earth's environment by developing and supplying products that are environmentally friendly and required by society, and through a range of business activities related to the above. We believe that all this helps ensure sustainable growth in our company value.

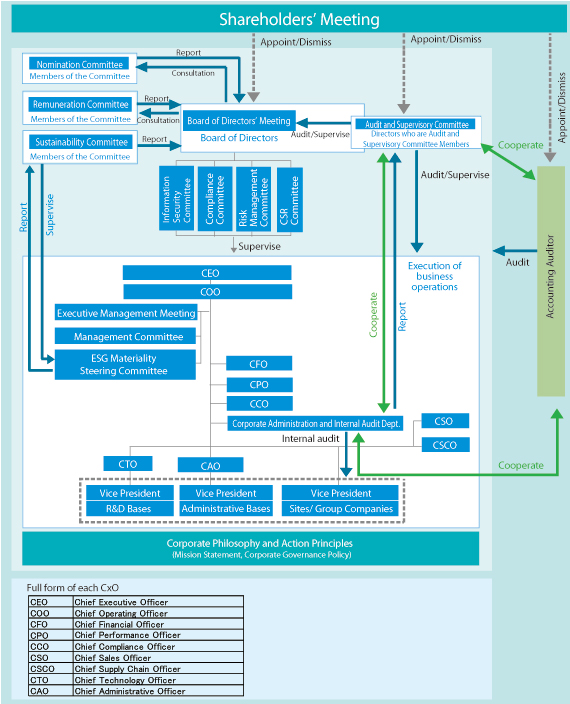

Business Execution and Management Oversight

The Board of Directors makes material management decisions and oversees the Group's business operations as a whole. The Board of Directors includes highly independent outside directors (non-executive directors), who are dedicated to monitoring managerial decisions from an objective perspective and further improving management transparency for all stakeholders.

The Audit and Supervisory Committee audits directors’ execution of business and receives reports from accounting auditors.

The Executive Management Meeting (Keiei-kaigi) and the Management Committee compose the Group's business execution mechanism and discuss specific operational issues. The Executive Management Meeting (Keiei-kaigi) convenes once a month to assess the present state of business and determine the next course of action, based on the monthly performance data and outcome of discussions at respective meetings where important group-wide concerns are shared among administrative departments, subsidiaries and business units. The Management Committee, the consultative body to the Representative Director and Chairman, is held and convened by President and Chief Operating Officer twice a month to discuss operational directions, plans, and other important considerations in the execution of business.

With a view to improving management efficiency, the Group has adopted an executive officer system and a business unit management system. The executive officer system delegates part of the Board responsibilities to executive officers, thereby allowing the Board of Directors to focus on more proactive, in-depth discussions on the Group’s strategic directions and enables executive officers to accelerate the execution of business. In the meantime, the business unit management system makes clear the locus of respective managerial responsibilities and contributes to the maintenance and improvement of a viable internal control system. Furthermore, the Group has adopted chief officer system. Each chief officer shares roles under the strong leadership of the Chief Executive Officer, and makes group-wide business execution to achieve the group’s business goals.

Internal Control

The Group commits itself to the enhancement of its management soundness and transparency by specifying risk management responsibilities and maintaining compliance capabilities generally required for listed companies in Japan. Through the auditing activities of the Corporate Administration & Internal Audit Department, a specialized oversight division, the Group regulates its internal controls over financial reporting and evaluates their effectiveness in the manner consistent with the Article 24-4-4, Paragraph 1 of the Financial Instruments and Exchange Act. In addition, the Legal & Compliance Department, Risk Management Committee, Information Security Management Committee and CSR Committee, all operating under the direct supervision of the Board of Directors, are dedicated to the creation of a strong internal control environment for the Group. Each Committee has its subordinate body, named the Compliance Office, the Risk Management Office, Information System Department and the IR & CSR Promotion Department, respectively.

Information Disclosure

The Group ensures strict adherence to its Disclosure Policy and conducts fair, timely and proper disclosure of information in order to offer appropriate accountability and transparency to shareholders and relevant stakeholders. Each disclosure item is carefully reviewed by the Disclosure Committee with respect to materiality, legality and adequacy of disclosure. In the meantime, shareholder opinions and viewpoints are constantly fed back to the management through day-to-day investor relations activities.

Subsidiary Governance

Unified under the same management principles, each company of the Group operates in compliance with Nidec's internal control system. The members of the management team at each Nidec subsidiary, including those sent from Nidec, undertake substantial discussions in managerial decision-making with a significant involvement of outside members of the Audit and Supervisory Board and experts to ensure that specific circumstances in each company are rationally considered and that each company's independency is appropriately assured.

Corporate Governance Structure

Board of Directors

Updated in June 21, 2023

| Shigenobu Nagamori | Founder, Representative Director, Chairman and Chief Executive Officer |

| Hiroshi Kobe | Representative Director, President and Chief Operating Officer |

| Kazuya Murakami |

Member of the Board of Directors who is an Audit and Supervisory Committee Member |

| Hiroyuki Ochiai |

Member of the Board of Directors who is an Audit and Supervisory Committee Member |

| Shinichi Sato | Outside Member of the Board of Directors |

| Yayoi Komatsu | Outside Member of the Board of Directors |

| Takako Sakai | Outside Member of the Board of Directors |

| Aya Yamada | Outside Member of the Board of Directors who is an Audit and Supervisory Committee Member |

| Junko Watanabe | Outside Member of the Board of Directors who is an Audit and Supervisory Committee Member |

| Hiroe Toyoshima | Outside Member of the Board of Directors who is an Audit and Supervisory Committee Member |

*Information regarding Outside Members of the Board of Directors attendance at the Company's meetings of Board of Directors is available in Proposals of Annual General Meeting of Shareholders.

*Outside Members of the Board of Directors refer to those who have not been directors, executive officers, managers or employees of the company or any of its subsidiaries at any time prior to the Board election.