Special Feature 2021 - Integrated Report 2021

Financial Strategy

In June 2021, our company reached a turning point since its founding, when Representative Director and President Seki assumed the office of CEO toward achieving the consolidated sales target of 10 trillion yen by FY2030. In July 2021, we announced the new medium-term strategic goal Vision 2025, which aims to achieve consolidated net sales of four trillion yen by FY2025. We will continue to take on further challenges and reform of the Nidec Group in terms of both financial and non-financial aspects, including balancing growth investment and financial discipline, and promoting ESG management.

New Medium-Term Strategic Goal Vision 2025

Consolidated sales target

In the medium-term strategic goal Vision 2020, whose final year was FY2020, the consolidated sales target of two trillion yen was not reached. To achieve this target by FY2022 and further achieve the consolidated sales target of 10 trillion yen by FY 2030, we have set the new medium-term strategic goal Vision 2025, which aims to attain the consolidated sales target of four trillion by FY 2025.

Of the consolidated sales target of four trillion yen by FY2025, three trillion yen and one trillion yen is expected to be gained through organic growth and through new M&A deals, respectively. In order to achieve consolidated net sales of three trillion yen by FY2025, excluding sales of one trillion yen through new M&A deals, it is necessary to achieve a CAGR (compound annual growth rate) of about 15%. Accordingly, it is important to shift our business port-folio to growth fields.

We have already secured orders for 3.5 million units of the EV traction motor system E-Axle for FY2025. The EV industry is experiencing structural changes such as the tightening of environmental regulations around the world, the emergence of fabless manufacturing, and an increase of new entrants into the EV market, and we believe that there are significant business growth opportunities for us. In the small precision motor department, we expect that motors for small EVs and electric two-wheeled vehicles will make an early contribution to profits as new business.

The Nidec Group will work as one to achieve consolidated net sales of four trillion yen by FY2025, thereby building a strong bridgehead to attain consolidated net sales of 10 trillion yen by FY2030.

Financial targets

In Vision 2025, a new medium-term strategic goal for FY2025, we have adopted ROIC (return on invested capital) as a new management target instead of ROE (return on equity), which was adopted in Vision 2020. We aim to reach 10% ROIC by FY2022 and 15% ROIC by FY2025 from an ROIC of 7.8%, which we achieved in FY2020.

The reason for adopting ROIC as a new management index is that we emphasize commitment to profitable growth and aim for growth through both “organic growth + new M&A deals” and “enhancement of profitability on capital.” For ROIC targets, we have broken down the targets for each business department to promote daily improvement activities.

Regarding investment, we expect to make a growth investment of over one trillion yen in total (mainly CAPEX and M&A) toward FY2025. Meanwhile, we foresee a CAPEX to sales ratio of about 5% in FY2025. For Cash Conversion Cycle (CCC), the actual result in FY2020 was less than 75 days. We will continue to work to improve CCC mainly by optimizing inventory while minimizing production continuity risk due to soaring raw material prices and disruption in the supply of parts and materials.

Regarding the procurement of funds necessary for investment in growth businesses and new M&A deals, our basic stance is to thoroughly manage funds within the Group mainly by shortening CCC and use funds from operating cash flow. If we need to raise funds, our policy is to choose the best way to raise money while comprehensively considering the required amount, financial situation, stock price and rating, financial market environment, and other factors.

ESG goals

In Vision 2025, we have incorporated the perspectives of ESG management into our goals. We have announced the following three ESG goals: ① addressing social issues with the accumulated skills of creating the world’s first and No. 1 products, ② promoting ESG management centered on carbon neutrality, and ③ strengthening the unified organization of the Nidec Group and its governance.

① Addressing social issues with the accumulated skills of creating the world’s first and No. 1 products

In our IR presentation materials, we have announced Nidec’s business solutions that solve the common problems of humankind to tackle the Five Big Waves. Recognizing again that the significance of our existence is to address social issues, we work to provide products and solutions to our customers.

② Promoting ESG management centered on carbon neutrality

As part of our climate change actions, we have set two goals: (1) achieving carbon neutrality for business activities (Scope 1 and 2) by FY2040 and (2) laying out a plan to reduce CO2 emissions in the supply chain (Scope 3) by FY2025. We will promote ESG management by working to reduce CO2 emissions attributable to our business activities and helping to solve social issues through the provision of products and solutions that contribute to decarbonization and energy saving.

③ Strengthening the unified organization of the Nidec Group and its governance

We receive many opinions and requests from investors every day regarding our governance system. To strengthen our governance system, we shifted to being a company with an Audit and Supervisory Committee in June 2020 and established the Remuneration Committee in February 2021. We will continue to improve the governance system to further enhance our governance.

IR Activities

We attach great importance to communication with investors (investor relations). In FY2020, we conducted many interviews with investors to respond to their interest in our stock, interviewing about 3,500 investors in total. As a result of these efforts, Nidec Corporation ranked No. 1 in all categories in the Electronics/Components business sector on Institu-tional Investor’s 2021 All-Japan Executive Team.

We also focus on IR for individual investors. We not only hold regular briefings for individual investors and securities companies’ sales staff but also take new measures, including participating in various events for individual investors and creating and publishing YouTube videos for them.

Shareholder Return Policy

While improving corporate value through business growth and expansion is an important issue for management, we also recognize shareholder returns as a key management theme. For dividends, we will continue to return profits to shareholders, while considering capital efficiency, after securing the necessary internal reserves for research and development, and the CAPEX and M&A required for future growth. For the acquisition of treasury stock, our basic policy is to purchase treasury stock as a means of implementing agile capital policies in response to changes in the business environment.

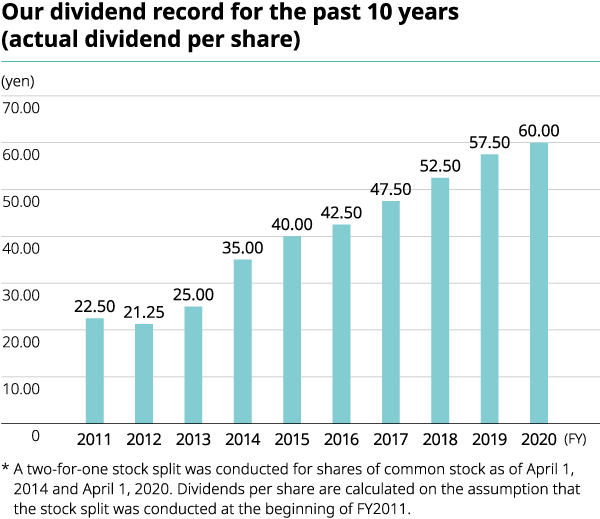

Regarding dividends, the dividend per share has steadily increased over the past 10 years, reaching an annual dividend of 60 yen per share and a dividend payout ratio of 28.8% in FY2020. For the acquisition of treasury stock, we purchased 2,850,200 shares (equivalent to 18,527,768,000 yen) between January 24, 2020 and January 22, 2021. We have also set limits for treasury stock acquisition at 50 billion yen (or 4,000,000 shares) for the period from January 26, 2021 to January 25, 2022.

We will strive to improve shareholder value, not only by accelerating growth investment to achieve the medium-term strategic goal while keeping balance with financial discipline, but also by promoting ESG management and other non-financial goals.