Special Feature 2022 - Integrated Report 2022

Financial Strategy

I was appointed Chief Financial Officer (CFO) on May 1, 2022. I served as the CFO of Mitsubishi Heavy Industries Machine Tool Co., Ltd. (currently Nidec Machine Tool Corporation), which Nidec acquired in August 2021, and now I have been appointed as Nidec’s CFO. I will cover the following three topics: 1. Nidec’s approach to financing, 2. Green bonds, and 3. Establishment of the Sustainability Committee.

Approach to financing

To achieve the consolidated net sales target of 10 trillion yen by FY2030, Nidec has set a sales target of 4 trillion yen in Vision 2025. Of this amount, 1 trillion yen is expected to be achieved through new acquisitions. Therefore, it is anticipated that there will be demands for capital investment associated with business growth and funds associated with new acquisitions. Our approach to the procurement of funds is based on thorough fund management, primarily by shortening the cash conversion cycle (CCC) within the Group and using funds from operating cash flow. Our policy for financing is to choose the best way to raise funds while comprehensively considering the required amount, financial situation, our stock price and rating, the financial market environment, and other factors.

In raising funds, our policy is to make the optimal choice at the time of financing while taking the financial market environment and our rating into consideration. Overseas central banks, led by the U.S. Federal Reserve Board (FRB), are shifting their course to raise interest rates and reduce monetary easing. In light of these major changes in the financial market, we will raise funds for medium- to long-term growth while incorporating the perspective of asset and liability management (ALM), such as cash flow projections for each fiscal year and matching sales and procurement currencies, as well as taking various factors including the following into consideration: both growth and financial discipline, the balance between direct and indirect financing, and the terms of procurement. Most recently, Nidec newly issued yen-denominated bonds*1 in July 2022.

*1 Conditions of issuance: [3-year bonds] Amount: 30 billion yen, coupon rate: 0.250%; [10-year bonds] Amount: 20 billion yen, coupon rate: 0.549%

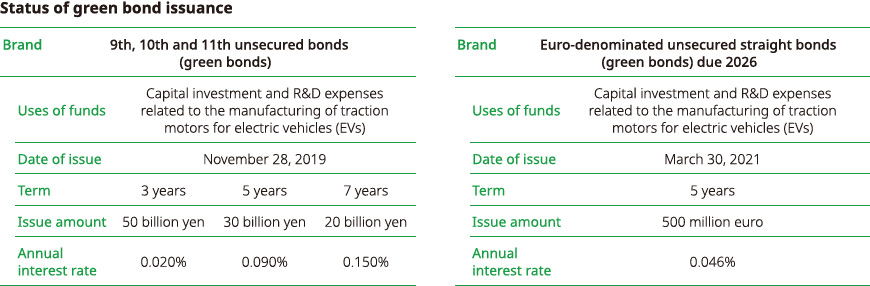

Green bonds

To use for capital investment and R&D expenses related to the manufacturing of traction motors for electric vehicles (EVs), we issued 100 billion of yen-denominated green bonds in November 2019. Moreover, in March 2021, we issued 500 million of euro-denominated green bonds as the first business company in Japan. The global green bond market surpassed USD 500 billion in annual issuance in 2021 and is expected to continue to grow.

Nidec regards the issuance of green bonds as an important means of raising funds to support its mission of contributing to the Earth by producing the highest quality motors in the world. We will continue to raise funds in various ways, including issuing green bonds in the domestic and overseas financial markets.

*2 For details of our green bonds, please see below.

https://www.nidec.com/en/sustainability/environment/greenbond/

*3 For the annual sales volume of our manufactured traction motor system (E-Axle), please see below.

https://www.nidec.com/en/sustainability/environment/greenbond/-/media/www-nidec-com/sustainability/environment/greenbond/img/202206_JPY-GreenBondReporting_en.pdf

*4 For the indicators related to environmental improvement effect, the reduced amount of CO2 emissions is calculated by taking the difference between the assumed amount of CO2 emitted by electric vehicles and that emitted by gasoline-powered vehicles.

*5 For the annual review by a third-party assessment organization, please see below.

https://mstar-sustops-cdn-mainwebsite-s3.s3.amazonaws.com/docs/default-source/spos/nidec-corporation-green-bonds-2019-and-2021-annual-review-(2022).pdf?sfvrsn=8b609e84_1

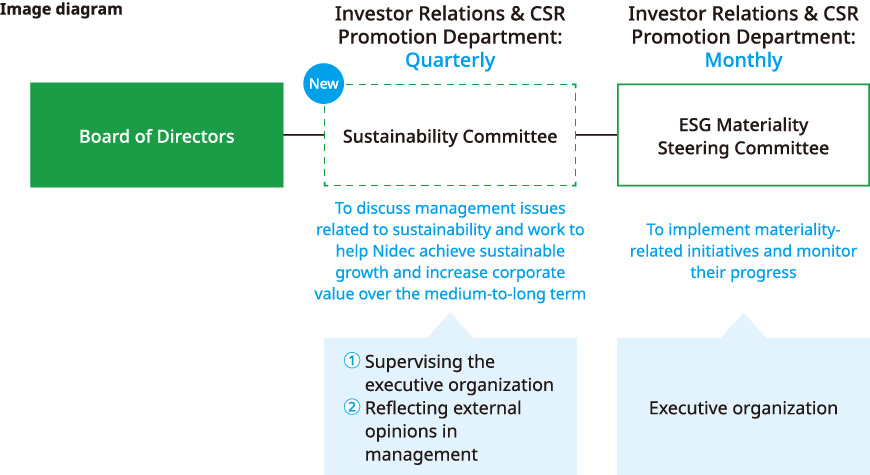

Sustainability Committee

We have set the promotion of ESG management as one of our mid-term strategic targets. In FY2021, we launched the ESG Materiality Steering Committee, which is mainly comprised of executive officers, and built a system to manage progress and verify the results monthly based on KPIs. In addition, from the perspective of promoting sustainability management that aims to realize a future that coexists and prospers with the environment and society, namely, the foundations of our business, we newly established the Sustainability Committee within the Board of Directors in August 2022, and the Committee launched its activities in September. As stated in Supplementary Principle 4-2*6 of the Corporate Governance Code revised in June 2021, we are aware that promoting sustainability management is also essential for us.

The Sustainability Committee is made up of five directors (including three outside directors) to fulfill the role of monitoring the ESG Materiality Steering Committee and reflecting the opinions of various stakeholders in management. The Sustainability Committee is comprised of diverse members with experience and expertise in such areas as human resource development, legal affairs/compliance, finance/accounting, international operations/global business, environment/society, and governance/risk management. Therefore, discussions from a wide range of perspectives can be expected.

*6 “The Board of Directors should formulate a basic policy for the company’s sustainability initiatives from the perspective of improving corporate value over the medium-to-long term. In addition, in light of the importance of investing in human capital and intellectual property, the Board of Directors should supervise the allocation of management resources, including those mentioned above, and the execution of strategies related to business portfolios in an effective manner so that resource allocation and strategy execution can contribute to the sustainable growth of the company.”