Special Feature 2023 - Integrated Report 2023

Financial Strategy

Management overview

Nidec celebrates its 50th anniversary this year. Since its founding in 1973, despite multiple difficulties it has encountered, Nidec has rapidly expanded its sales scale in growth fields, which reached 1 trillion yen in FY2014 and exceeded 2 trillion yen in FY2022. Along with the growth in sales, profits have also steadily increased.

In 2019, as a result of quickly sensing signs of rapid progress of the shift to EVs in the automotive field and deploying a “standby” strategy by making advance investments, we gained the top share in the E-Axle external manufacturing market in China. On the other hand, the E-Axle business, which was a heavy burden on profits over the past few years, turned into the black this fiscal year, entering a stage of contributing to our profits.

Against the backdrop of the spread of COVID-19 and the Russian invasion of Ukraine, the soaring raw materials prices, longer lead times, and confusions in logistics had a significant impact on business management on a global basis. As a result, we were forced to secure raw materials through large-lot orders, while inventory adjustments by customers prolonged due to rapid fluctuations in demand, which continued to put pressure on our balance sheet. However, the business environment is gradually returning to normal.

Shift to a dream-filled business portfolio

In FY2022, our sales were 2,242.8 billion yen and operating profit was 100.1 billion yen. Operating profit decreased significantly by 41.3% from the previous fiscal year due to recording of 75.7 billion yen as structural reform expenses.

In this business environment, toward achieving the net sales target of 4 trillion yen announced in Vision 2025 and further 10 trillion yen in FY2030, we are working on electrification-related businesses, including not only the automotive E-Axle business but also motors for small EVs and electric motorcycles; entry into the machine tool business; new initiatives in the field of equipment and devices, such as reducers for cooperative robots; businesses for the aerospace market, such as motors for Flying Cars (eVTOLs) and stratospheric communication platforms; and the introduction of green innovation-related projects, such as battery energy storage systems and charging stations. By not only leveraging organic growth but also employing M&A strategies, we are strongly promoting a shift to a dream-filled business portfolio incorporating growth areas for the future.

Building a solid financial foundation to support growth strategies

Now the top priority in our financial strategy is to build a solid financial foundation that supports the growth strategy for the next leap forward. For this reason, we carried out a large-scale structural reform last fiscal year and advanced a shift in the structure of fixed costs to one that matches the future business portfolio. Based on this, we will realize a V-shaped recovery in earnings and at the same time strongly promote various measures, such as significantly improving the cash conversion cycle and increasing investment efficiency by balancing investment with depreciation costs, from the perspective of One NIDEC/total optimization. Through these measures, we will ensure robust financing capacity so that we will not miss any growth opportunity.

Financing policy and effective use of funds within the Group

In financing, we raise funds for medium- to long-term growth while incorporating the perspective of asset and liability management (ALM), such as cash flow projections for each fiscal year and matching sales and procurement currencies, as well as taking various factors, including the following, into consideration: both growth and financial discipline, the balance between direct and indirect financing, and the balance between long-term and short-term procurement. Through these measures, we aim to stabilize our financing structure.

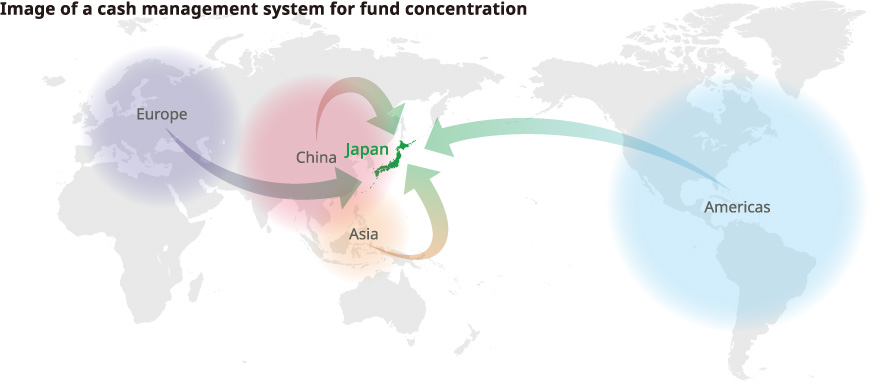

In addition, to ensure effective use of funds within the Group, a cash management system has been introduced for each region, such as Japan, China, and the Americas, to effectively utilize surplus funds. We have also introduced a CMS that connects different countries, expanding the CMS network globally. Furthermore, in consideration of recent geopolitical risks, we aim to hedge risks and also reduce interest-bearing debt by redirecting surplus funds to Japan from other countries.

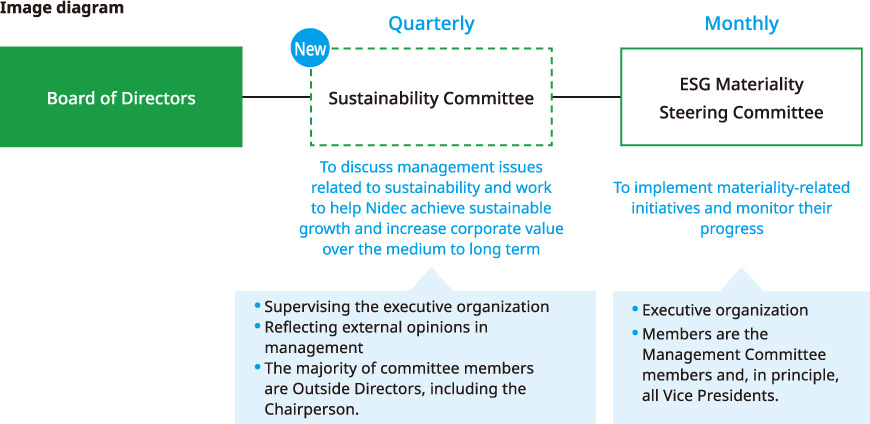

Evolution of ESG management

“Sustainable business growth takes hold when strategies align closely with solutions to universal issues. That is our firm belief and the common thread running through our growth-oriented thinking.” Under this basic belief, Nidec upholds the promotion of ESG management as one of its medium-term strategic targets. Last year, we established the Sustainability Committee within the Board of Directors. With the knowledge of Outside Members of the Board of Directors, who make up the majority of the committee members, active discussions are held from a long-term and wide-ranging perspective. Through earnest, continuous discussions, we will enhance the sustainability of our business management.