Mid-Term Management Plan

Mid-Term Management Plan Conversion 2027

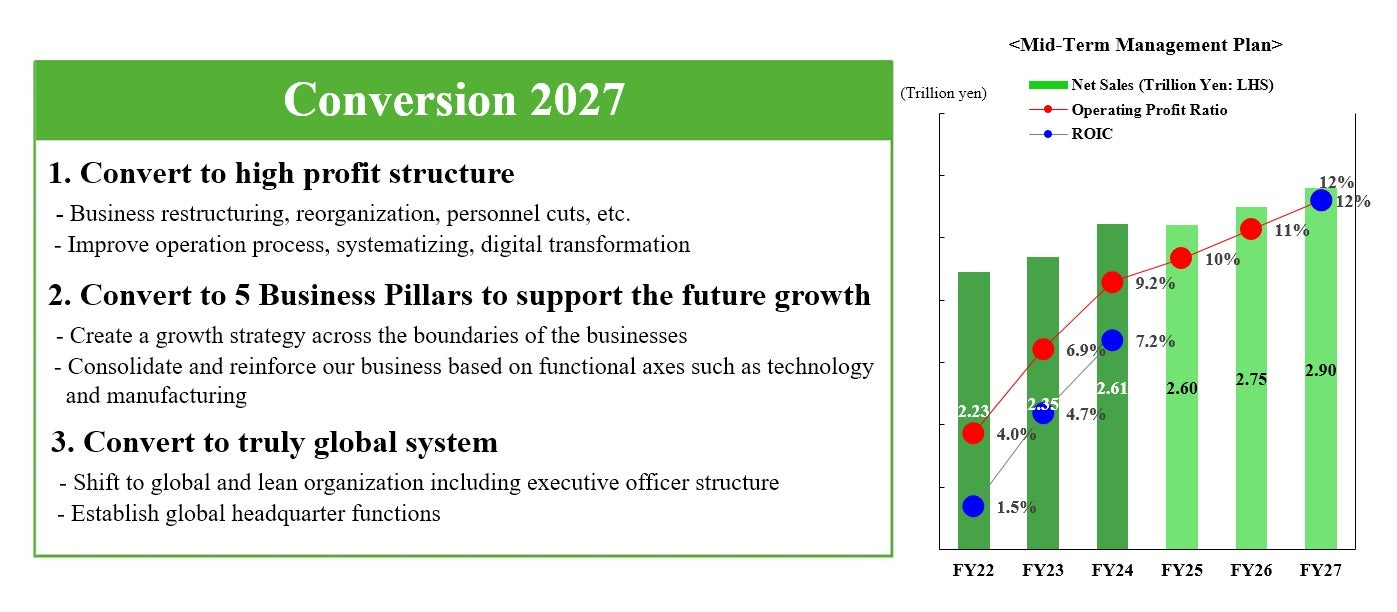

The Mid-Term Management Plan Conversion 2027 aims to fundamentally transform our earnings structure and improve profitability by executing three conversions from three perspectives. Our numerical targets for FY2027 are: consolidated net sales of 2.9 trillion yen, operating profit of 350 billion yen (Operating profit margin of 12%), and a ROIC of 12%.

1) Convert to High Profit Structure

Business Portfolio Management through ROIC-based Management

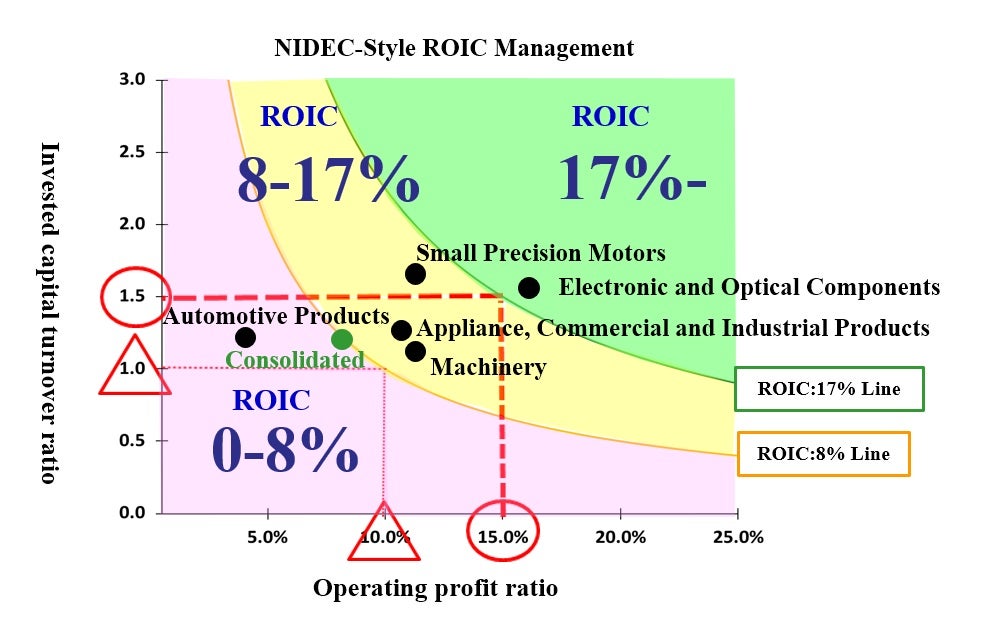

To achieve our numerical targets for FY2027, we are identifying non-profitable and non-core businesses. The foundation of this effort is NIDEC-style ROIC Management, which helps us visualize the current state of our business portfolio by categorizing businesses based on ROIC. We are evaluating businesses with promising future growth, businesses that can provide technical contribution to other segments, and businesses where the market is expected to shrink. Through these initiatives, we aim to optimize our business operations as a group, increase the ratio of highly profitable businesses, and transform our earnings structure.

Consolidation and Optimization of Locations

Nidec Group has approximately 250 production sites, with about 30% of them being small-scale locations with 100 employees or fewer. We are proceeding with the consolidation and merger of these entities with the goal of reducing their number by half and cutting staff, primarily in indirect manufacturing departments. Furthermore, even large-staff entities will be subject to efficiency improvements if their productivity is low.

By transitioning to this kind of management focused on overall optimization, we plan to execute reforms amounting to 100 billion yen in variable costs and 50 billion yen in fixed costs.

Expanding High-Value-Added Business Areas

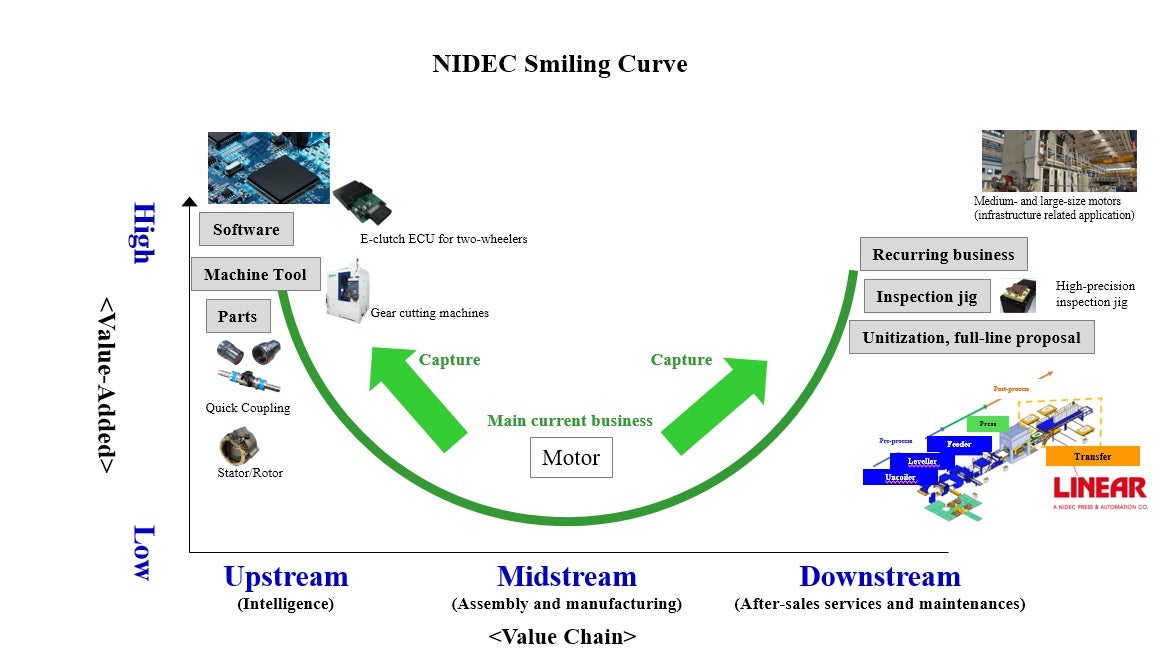

As the world's #1 leading comprehensive motor manufacturer, our mission to supply high-quality motors remains unchanged. However, to capture more business opportunities in the future, it is crucial that we enhance value across the entire value chain, not just by providing motors by themselves. For example, we will strengthen our machine tool and software businesses at the upstream end of the value chain, which form the foundation of manufacturing. Downstream, we will expand after-sales services, including recurring business and maintenance, primarily in our large-size motor business. Through these initiatives, we will elevate both ends of the Value-Added Smile Curve to create new business opportunities that differentiate us from our traditional motor-centric business model.

2) Convert to the Five Business Pillars Structure to Support the Future Growth

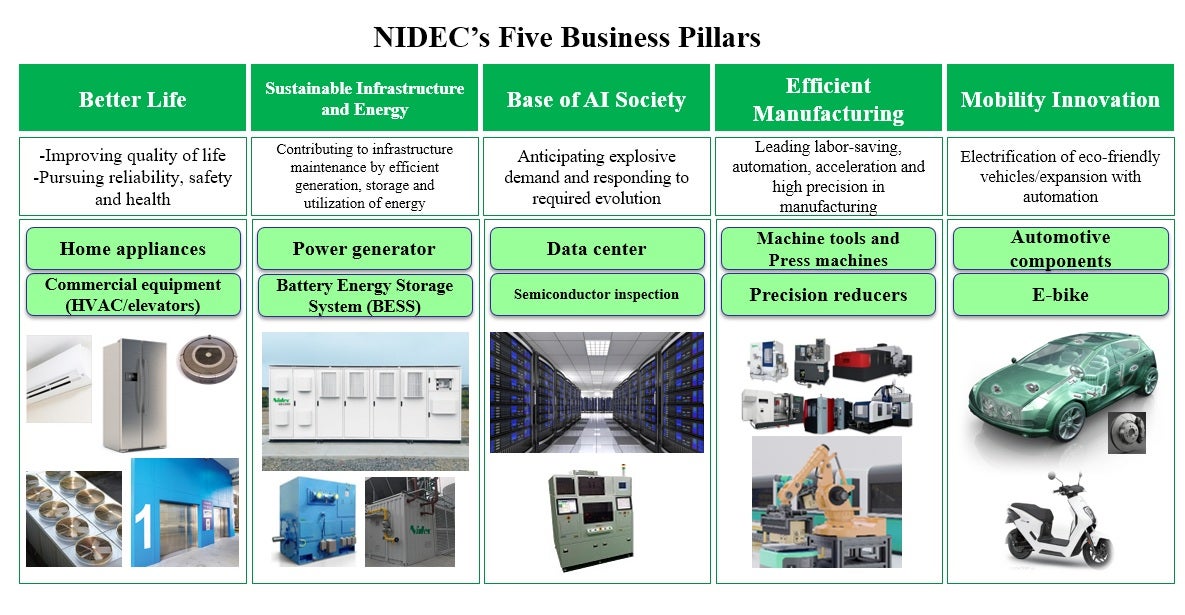

We have identified five core business pillars for future focus: 1. Base of AI Society, 2. Sustainable Infrastructure and Energy, 3. Efficient Manufacturing, 4. Better Life, 5. Mobility Innovation.

Going forward, we will conduct technology and product development based on these five pillars.

In addition, we have appointed a business head for each of these Five Business Pillars to oversee the opportunities and challenges in their respective areas and to drive effective strategies. We have also defined the key regions, target customers, and themes for each pillar. This new structure assigns responsibility more clearly for business growth and increasing corporate values.

3) Convert to Truly Global System

To strengthen our corporate functions, we reorganized into a new structure in April 2025. While streamlining the number of executive officers, we appointed new Chief Digital Officer (CDO), Chief Human Resources Officer (CHRO), and Chief Legal Officer (CLO), thereby reinforcing our Chief Officer (CxO) system. Furthermore, to further improve technology and quality, we have established new positions for Fellows, who possess advanced technical skills, expertise, and knowledge, and Senior General Managers, who are candidates for future executive officers. Through this new organizational structure, we will achieve a transition to a truly global system.