Medium-and Long-Term Strategic Goals

Medium-Term Strategic Goal Vision 2025

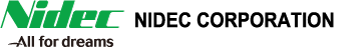

Based on the medium-term strategic goal we announced in July 2021, we aim to achieve sales of four trillion yen and ROIC of 15% of more by FY2025. To be a top-rated ESG company, we will address social issues with accumulated skills of creating the world’s first and No.1 product, promote ESG management centered on carbon neutrality, and strengthen unified organization of NIDEC group and its governance.

To achieve our goal of reaching four trillion yen in net sales in FY2025, we are aiming 800 billion yen sales in Small Precision Motors, 1,300 billion yen sales in Automotive Products, 1,300 billion yen sales in Appliance, Commercial and Industrial Products, and 600 billion yen sales in Others, including contribution of M&A to sales.

Small Precision Motors

We will aim to increase the sales of small precision motors to a 800 billion yen range by FY2025 by focusing on creating new demands based on our technical advantages and improving profitability based on our competitive advantages.

Small Precision Motors segment has HDD Motors business and Other Small Motors business. HDD is mainly used in personal computers, servers and many other kinds of information-processing equipment, and the HDD motor serves as the heart of the HDDs. We will endeavor to improve profitability in the HDD Motor Business. Although the proliferation of tablets, smartphones and other new IT devices has limited further expansion of the PC market, we have entered the age of big data, which is characterized by high quality and high capacity for images, videos and other content as well as the spread of social media and games. The accompanying increase in the demand for storage capacity is expected to keep the demand for HDD motors for servers and other equipment stable in the future.

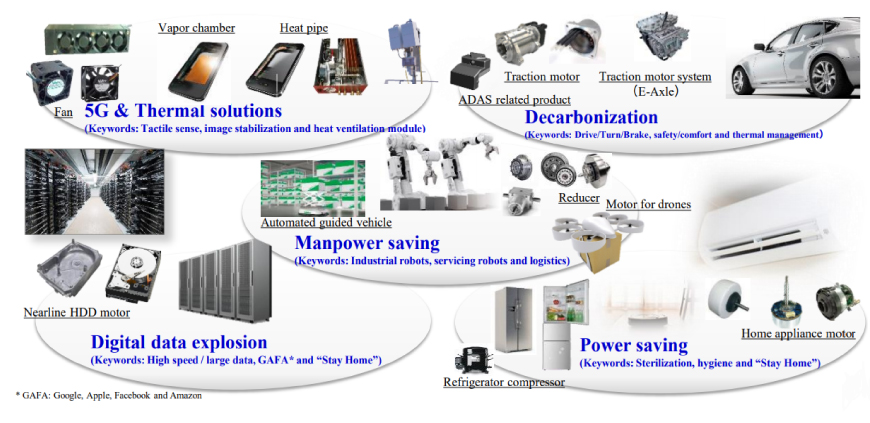

We expect demands for 5G & Thermal solutions, replacement with brushless DC motors, and small mobility. When 5G communications become the mainstream, the communication speed will increase by 100 times and the communication capacity will increase by 1,000 times. However, intense heat is generated in the CPU (Central Processing Unit) and electronic circuits due to a huge amount of data being processed at a high speed. Therefore, it is expected that the demand for thermal management such as heat dissipation and cooling will increase more and more. To meet this demand, we provide the market with thermal module products that combine heat sinks, heat pipes, vapor chambers, and others. Demand for brushless DC motors, which has such features as energy-efficiency, long-life expectancy, and low-noise, will increase more and more as home appliances become energy efficient and cordless. Also, small mobility which electrification is processing in will lead our growth in a medium-and-long term. Furthermore, we will explore its new usage in a wide variety of fields such as AV, IT, OA and communication equipment, home appliances, and industrial equipment, achieving to sustainable growth.

Automotive Products

Aiming for net sales of 1,300 billion yen by FY2025 by developing products with high-value-added modules.

In the automotive business, as the impact of climate change increases in severity, the automotive industry is accelerating its efforts toward decarbonization. Since passenger cars, trucks, and others account for approximately one fifth of the total CO2 emissions in the world, major countries have announced a ban on the sales of gasoline and diesel vehicles one after another, and are supporting the vehicle electrification and the shift to electric vehicles. We take “automotive electrification” and “green transformation” as medium- to long-term growth opportunities, and provides automotive motors such as electric power steering motors and brake motors, for which we have the largest market share, as well as automotive products such as electric oil pumps, electric water pumps and others. Furthermore, by developing and supplying drive motor system (traction motor) for EVs, which is equivalent to the engine part of a gasoline vehicle, we will actively participate in the industry's efforts to reduce the CO2 emitted by running vehicles to virtually zero. By combining these with an electronic control unit (ECU), each part can be systemized and high-valueadded modular products can be provided. In addition, by integrating motors, ECUs, sensors, and others to electronically control various vehicle functions, safe driving, collision avoidance, damage reduction, and automatic driving will become possible, which will enhance vehicle safety. Furthermore, reducing CO2 emissions can also be expected by improving fuel efficiency. In the future, aiming to become an automotive electrics manufacturer, we will contribute to the development of safer, eco-friendly and comfortable cars by providing the automotive industry with system module products that integrate advanced technologies of sensor and ECU into motor technologies we have accumulated.

Appliance, Commercial and Industrial Products

Aiming for net sales of 1,300 billion yen by FY2025 by pursuing synergistic effect in both sales and costs and improving profitability in these key growth businesses.

Motors currently account for approximately half of the world's electric power demand, and since the consumption of industrial motors is particularly large, there is an urgent need to replace them with higher efficiency motors. In the appliance sector, we handle motors for washing machines, dryers, dishwashers, compressors for refrigerators, motors for compressors and others. Riding the wave of “home appliances driven by brushless DC motors,” we will contribute to higher efficiency of appliances such as refrigerators. The commercial sector deals with air conditioner motors, and the industrial sector develops business mainly in markets such as agriculture, gas, mining, water and sewage, and marine markets. There is a global trend toward energy-efficiency and power-saving, and we are aiming for further development of the appliance, commercial, and industrial businesses by following this trend.

Others

Aiming for net sales of 600 billion yen by FY2025 by improving our speed reducers production capacity for small robots.

Demand for factory automation (FA) is increasing mainly in China, aiming to solve the global labor shortage. We are promoting business expansion by capturing demand for small robot core parts (speed reducers), which is expanding due to the “expansion of robot applications.” In order to reliably win the increased orders, we have started the operation of a new factory for speed reducers for small robots, and has significantly increased its production capacity.

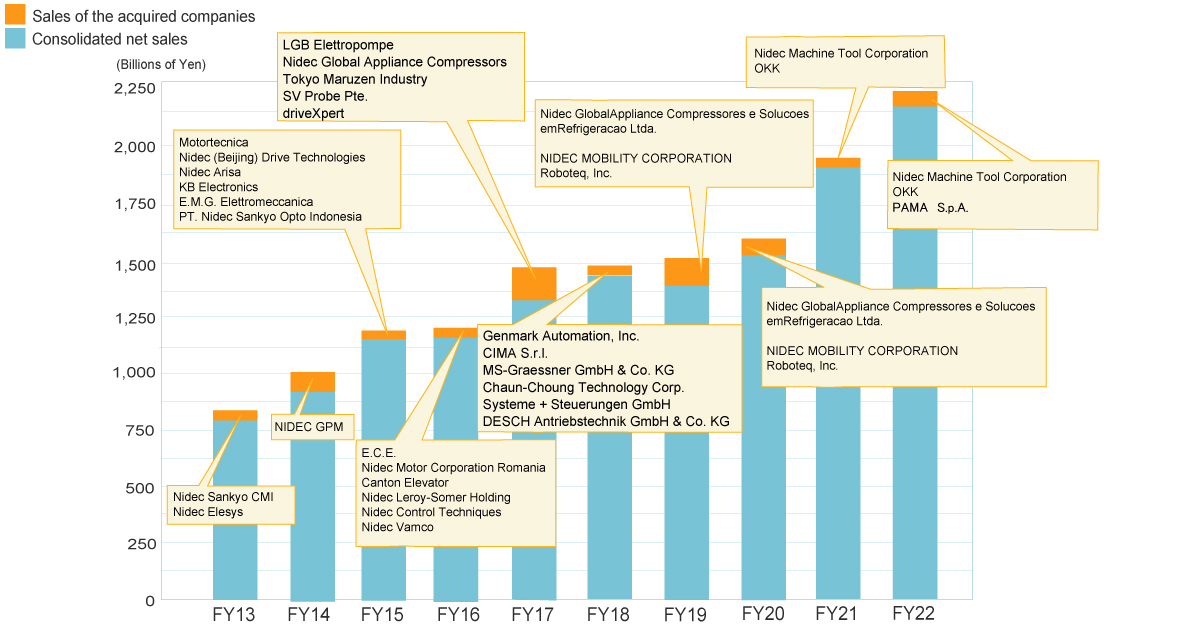

M&A

M&A is an essential part of our growth strategy

We seek business acquisitions that allow us to gain access to prospective technologies, new customer groups and untapped geographic markets. This is particularly the case when addressing the markets for automotive systems, home appliances and industrial equipment, which are vastly diversified and prone to exhibit distinct regional variations in customer preferences. In other words, business acquisitions will help swiftly globalize our motor production and supply networks in a manner that matches each regional need. Also, we will pursue business acquisitions that effectively diversify our business risks.

Long-term Goal: Net Sales Worth 10 Trillion by FY2030

NIDEC has grown into an enterprise with net sales exceeding one trillion yen in just over 40 years since it was established in 1973. Our growth was particularly remarkable due to the tremendous spread of personal computers from the late 1990s.

The present age is riding on five big waves of innovation, against the backdrop of social issues such as global warming and shortage of labor. NIDEC seeks to make the most of the business opportunities arising from these waves and achieve net sales worth 10 trillion yen by FY2030.