G/Governance

Risk Management

Basic stance

It is necessary and important to identify and manage risks for the purpose of preventing the expansion of losses due to lack of readiness for possible risks, loss of business opportunities, decline of ratings, and other negative impacts. If the department responsible for appropriately managing risks is not identified, or if risk assessments are not carried out and risks that should be dealt with as a priority are not identified, it will be impossible to take appropriate action in the event of unexpected circumstances, and there is a possibility that this could have a serious impact on the business. The NIDEC Group is working to ensure business continuity by taking a global perspective and looking at both medium- to long term risks and day - to - day risks that could affect the business. To this end, we have established a system for investigating and evaluating risk events while confirming the effectiveness of current countermeasures.

Target

Materiality

Systems and actions

Risk management system

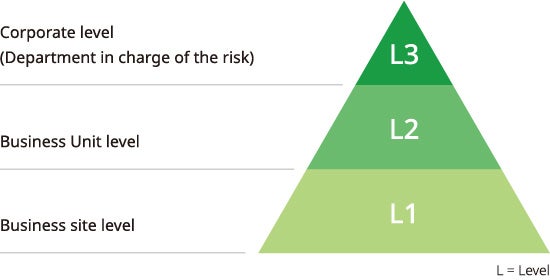

Nidec revised our risk management system, launched risk assessment on each level of the hierarchy shown below, and established a system to mutually use assessment results for the measures for other levels in 2021.Thus, we interconnect the risk management activities of different hierarchical levels by, for example, checking risks identified in L2 in L3 as well, and, reflecting group-wide issues in L3-level risk management activities as necessary if such issues are found in those risks.

For serious contingent risks that may lead to business interruption, the Business Unit level (L2) organizations will periodically check the status of the formulation of BCPs (Business Continuity Plans) of the major business site* level (L1) organizations under their control, thereby ensuring that improvement activities are continuously conducted for risk reduction.

*Major business sites: Business operation sites that make up 80% of sales of the Business Unit or Group company they belong to

Mid/long-term risk management

The Nidec Group uses a mid-term business plan, which is designed to realize the group’s long-term vision that is defined as a set of specific numerical and qualitative targets, as a basis of the group’s business plan for each fiscal year. Our mid-term plan is created based on: discussion on its feasibility as a plan; consistency with our long-term plan; and issues and risks for us to overcome to achieve the vision. Each mid-term plan is revised (rolled) during its execution phase, based on changes in the market and the status of execution.

Daily risk management

We established “Risk Management Regulations” to manage the risks of the entire Nidec Group, and have in place a Risk Management Committee under the Board of Directors. Every fiscal year, the leaders of risk-bearing departments and companies prepare and execute their annual risk management plans based on an annual policy made by Risk Management Committee.

The Risk Management Office works as the Risk Management Committee’s secretariat to support the plans, while the Corporate Administration & Internal Audit Department audits the conditions of this risk management system.

Additionally, we promptly report and share important information with one another in the risk management meeting held every morning, and utilize the information in daily work, while as necessary extensively discussing and sharing such information in the Management Meeting as well.

For specific risks that the Nidec Group currently manages, please click here.

Risk Management Committee

The Risk Management Committee is placed under the Board of Directors and chaired by the executive officer in charge of risk management. The Committee decides risk management policies and measures and submits reports and proposals to the Board of Directors. It also monitors the company-wide risk management status and constantly reviews the adequacy of allocation of resources necessary for risk management. Based on the annual policies established by the Risk Management Committee, department general managers in charge of risk management and Group companies formulate and carry out their respective annual risk management plans.

Crisis management

In anticipating crisis response in reality, we have in place a practical crisis handling procedure (with a flowchart and a checklist) based on the “Crisis Management Regulations” and the “BCP (Business Continuity Plan) Basic Policy,” both of which cover the entire Nidec Group.

BCP (Business Continuity Plan)

With risk managers at individual business sites all around the world and other associated personnel, the Nidec Group tries to ensure early detection of, and proper response to, matters that could hamper business continuity. The training, participated by a total of more than 3,570 employees as of the end of March 2024, helped them improve their skills to counter such events.