Special Feature 2023 - Integrated Report 2023

Corporate Governance ― Create a solid governance system ―

Follow thorough compliance with laws and regulations, Build a risk management system, Promote information security measures

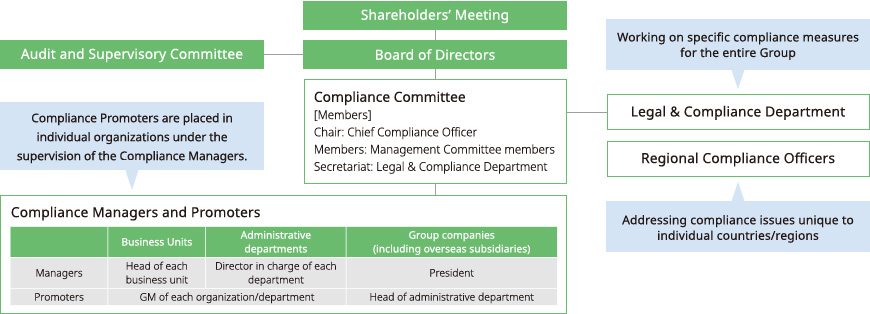

Follow thorough compliance with laws and regulations

Basic stance

The Nidec Group sees non-compliance as a material risk that may lead to a loss of social trust and economic damage. Therefore, the Nidec Group comprehensively follows applicable laws, regulations, internal rules and standards, social ethical standards, etc. to raise executives’ and regular employees’ ethical awareness, develop conscience as a company, and win society’s trust as we continue our compliance activities.

At present, we are working to establish and enhance a global compliance system that will enable us to address individual issues and cases arising in different regions more promptly and appropriately. We will also strengthen compliance education for employees to further raise their compliance awareness, thereby reducing compliance-related risks.

Efforts made in FY2022

The Nidec Group currently has over 300 group companies in 40 countries around the world. We recognize that building a governance system for these globally distributed group companies is a crucial task in ensuring compliance. In particular, based on our past experience, we see difficulty in identifying the risks of small companies located far from major bases. Therefore, we launched a hazard map project in FY2021 with the aim of preventing compliance risks from arising at these remote small sites. In this project, we constantly identify high-risk group companies based on their distance from major sites and the information on the risk of corruption in countries where they are operating and implemented specific prevention measures in consultation with the management of such companies and other risk reduction activities.

Toward the future

We will continue the hazard map project for a certain period of time to identify high-risk companies in order from those with the highest risk to reduce the governance risk at remote small sites. We will implement risk reduction activities, including for companies that have newly joined the Nidec Group through acquisitions.

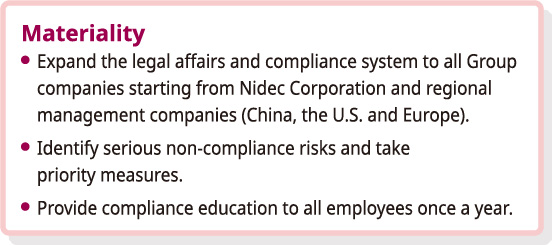

Organization

Nidec’s Legal & Compliance Department, working in partnership with Regional Compliance Officers of the individual regions where the Nidec Group’s business bases operate (the Americas, China, Europe, and Southeast Asia) and Compliance Managers and Promoters of individual business departments and group companies, builds and operates a global compliance system. Compliance Managers implement and operate compliance-related measures to raise the compliance awareness of the organizations under their supervision, and bear responsibility for preventing compliance violations. Compliance Promoters promote the specific compliance measures of such organizations, while serving as a liaison with the Legal & Compliance Department and Regional Compliance Officers, who provide support for individual regions’ Compliance Managers and accept whistleblowing cases.

Internal reporting system

As part of the comprehensive, group-wide compliance system, we have established an internal reporting section (the Nidec Global Compliance Hotline) available for all board members, executives and employees (including regular and part-time employees, those dispatched from outside agencies, limited-term employees, and those who have retired from the Nidec Group within a year), and a third-party contact point outside the company. Fiscal 2021 saw a total of 124 cases of whistleblowing and consultations made on suspected misconduct and harassment, among others, an increase of 8 cases from the previous fiscal year. The status of internal reports is reported to the Board of Directors and the Audit and Supervisory Committee on a regular basis.

Compliance seminars

As part of the compliance promotion activities, we hold compliance seminars for our group’s executives and employees to maintain and improve their level of compliance awareness. For example, seminars and discussions are held on such topics as cartels, bribery and human rights issues, with the Regional Compliance Officers serving as lecturers using the Nidec Compliance Handbook as teaching material. The compliance seminar for board members and executives is also held once a year, with the invitation of an outside lecturer.

Regarding violation of the regulation of distributable amount

At the Board of Directors’ meeting held on October 24, 2022, Nidec resolved to pay a dividend of 35 yen per share and implemented it. However, in the process of examining the distributable amount for the fiscal year ended March 31, 2023, it was discovered that the interim dividend in question exceeded the distributable amount calculated in accordance with the Japanese Companies Act and the Regulation on Corporate Accounting.

In addition, a subsequent investigation revealed that the Company’s share repurchase conducted by the trust bank under the trust agreement from September 1, 2022 through March 31, 2023 also exceeded the distributable amount. In response to this situation, the Company conducted an investigation on this matter by the External Investigation Committee, consisting of external attorneys. On June 16, 2023, the Company received the investigation results from the Committee. For details, please refer to the investigation report posted on our website. Nidec will take measures to prevent recurrence based on the proposals of the External Investigation Committee and work to further improve the Company’s corporate governance.

For the investigation results, click the URL below.

https://www.nidec.com/en/ir/news/2023/news0616-01/

The Nidec Group’s global compliance system

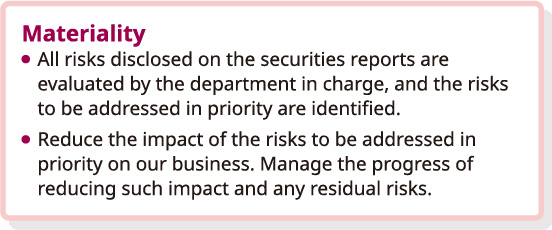

Build a risk management system

Basic stance

It is necessary and important to identify and manage risks for the purpose of preventing the expansion of losses due to lack of readiness for possible risks, loss of business opportunities, decline of ratings, and other negative impacts. Nidec has identified risks facing the Nidec Group, clarified the relevant departments, and determined the risks that should be reduced in order of priority. The Company manages the progress of reducing the impact of such risks on our business while working to enhance its initiatives to identify signs of risks.

Initiatives in FY2022

In FY2021, we reviewed our risk management system and established a system to conduct risk assessment on each level of the hierarchy shown below and mutually use assessment results for the measures for other levels. In FY2022, we worked to identify areas for improvement by continuing to conduct risk assessment, priority risk identification and risk reduction activities for the Business Unit level (L2), which were initiated in FY2021. We interconnect the risk management activities of different hierarchical levels by checking the risks identified in L2 in the corporate level (L3) as well and reflecting company-wide issues that should be addressed under the leadership of L3, if any are found, in L3-level risk management activities as necessary.

Toward the future

In FY2023, we will establish a new system at all levels, including L1 (major business site* level). In particular, for serious contingent risks that could lead to business interruptions, the Business Unit level (L2) periodically checks the status of the development of the BCP (Business Continuity Plan) at the major business site* level (L1) under its umbrella and works to ensure that improvement activities are continuously conducted for risk reduction.

* Major business sites: Business sites that are selected to cover 80% of the sales of the Business Unit or Group company to which they belong

Risk management system

The Nidec Group uses a medium-term business plan, which is designed to realize the Group’s long-term vision, which is defined as a set of specific numerical and qualitative targets, as a basis of the Group’s business plan for each fiscal year. Our medium-term plan is formulated based on discussions on its feasibility as a medium-term goal, consistency with our long-term vision, and issues and risks for us to overcome to achieve the vision. Each medium-term plan is revised (rolled) during its execution phase, based on changes in the market and the status of execution.

We have also formulated the Risk Management Regulations to establish a risk management system for the entire Nidec Group and have in place a Risk Management Committee under the Board of Directors. Additionally, we promptly report and share important information in the risk management meeting held every morning so that the information can be utilized in our daily operations. Such information is also extensively discussed and shared in the Senior Managers’ Meeting as necessary.

BCP (Business Continuity Plan)

Starting from March 2014, the Nidec Group has conducted BCP simulation training assuming such risks as an earthquake, flooding, drought, outbreak of an infectious disease, and fire at its sites both inside and outside Japan. The training, with a total of more than 3,430 employees participating as of the end of March 2023, helped them improve their skills to respond to such events. To respond to the COVID-19 pandemic, we set up a COVID-19 Crisis Management Headquarters from January 2020 to May 2023. In FY2022, we were hit by the Shanghai lockdown and the spread of infection following the dissolution of China’s zero-COVID policy, but we were able to minimize the impact on our business by working together as a Group in securing logistics.

Risk Management Committee

The Risk Management Committee is placed under the Board of Directors and chaired by the executive officer in charge of risk management. The Committee decides risk management policies and measures and submits reports and proposals to the Board of Directors. It also monitors the company-wide risk management status and constantly reviews the adequacy of allocation of resources necessary for risk management. Based on the annual policies established by the Risk Management Committee, department general managers in charge of risk management and Group companies formulate and carry out their respective annual risk management plans.

Promote information security measures

Basic stance

The Nidec Group possesses information that is necessary for conducting its business activities, including not only the information produced or gathered within the Group but also information provided by its business partners. We understand that it is very important to protect and use these information assets properly and appropriately. Information that should be protected includes management information, technical information, financial information and personal information, which are extremely important. Deterioration or leakage of any such information may lead to loss of trust in us from our customers or the market, as well as a decline in our competitiveness. It may also result in a legal penalty.

We will work to prevent serious security incidents by identifying and assessing rapidly changing and increasing information security risks and taking effective measures according to the risks.

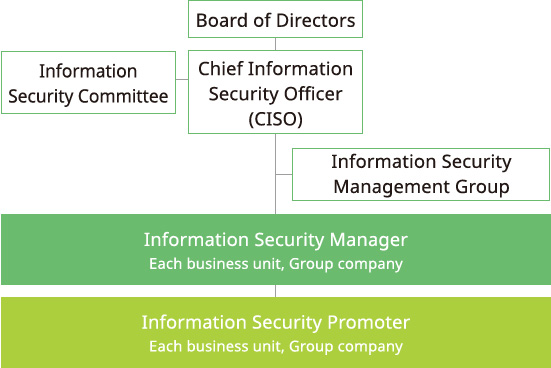

Information security structure

Initiatives in FY2022

In order to strengthen information security measures for the entire Nidec Group, we established and rigorously operated an information security management system and thoroughly implemented basic measures across all Group companies, including clarifying important information assets and providing information security training for directors and employees. In response to increasingly sophisticated cyber-attacks, we promoted the introduction of defense mechanisms to prevent unauthorized access from outside the Company and to detect and immediately block malicious programs such as computer viruses, thereby enhancing information security for the entire Nidec Group in terms of both structure and technology. As a result, no serious incidents due to cyber-attacks or other causes occurred in FY2022.

Toward the future

- Strengthening measures against internal information leaks

We have actively developed and implemented measures against “external threats” such as cyber-attacks and intrusion of malicious programs into the Company’s computer network, which are becoming more and more threatening every year. In the future, we will also enhance measures against “internal threats” such as information leaks.

There are two types of information leaks: “negligence,” which is the result of carelessness or disregard for rules, and “fraud,” which is the misuse of rights and privileges. To prevent information leaks due to negligence, we will systematically ensure compliance with internal rules while raising employees’ awareness of risk management to ensure thorough implementation of basic procedures that can prevent negligence. Meanwhile, in order to prevent fraud by insiders, we will make known to employees fraudulent acts that deviate from the rules. We will also introduce a system to monitor fraudulent acts to strengthen information management. - Improving information security management capabilities centered on the automotive business

In the automotive business, we will continue to implement measures based on cyber security guidelines for the automotive industry and strengthen our capabilities to respond to cyber incidents. We will also establish a voluntary improvement process of self-inspection, evaluation, and improvement for security risks that change year by year, not only in the automotive business but also in other businesses. At the same time, we will improve the information security management capabilities of the entire Group by effectively using information security assessment services provided by external organizations to strengthen monitoring of vulnerable areas and promptly make improvements.