G/Governance

Corporate Governance and Internal Control

With conscience and integrity, Nidec aims to earn society’s trust, and increase corporate value sustainably based on the motto, “high growth, high profit, and high share price”

Purpose of the Nidec Group’s corporate governance system

By exercising corporate governance, the Nidec Group intends to become a conscientious and principled company that earns society’s trust, and to increase corporate value sustainably based on the motto, “high growth, high profit, and high share price.” It is to this end that we maintain and enhance our internal control, run our business healthily and efficiently, and disclose information appropriately to increase the transparency of the company’s business operations.

Corporate governance system

Nidec’s basic policy is to exercise the motto, “high growth, high profit, and high share price” to enhance its business management and management system based on “the Aim of the Nidec Corporation” and the “Three Principles of Our Operations.” The main organizations in place to realize these basic policies include the Board of Directors and the Audit and Supervisory Committee, both in accordance with the Companies Act of Japan, and Nomination Committee, Remuneration Committee, Sustainability Committee, executive organs of the Monthly Executive Meeting and the Executive Management Meeting.

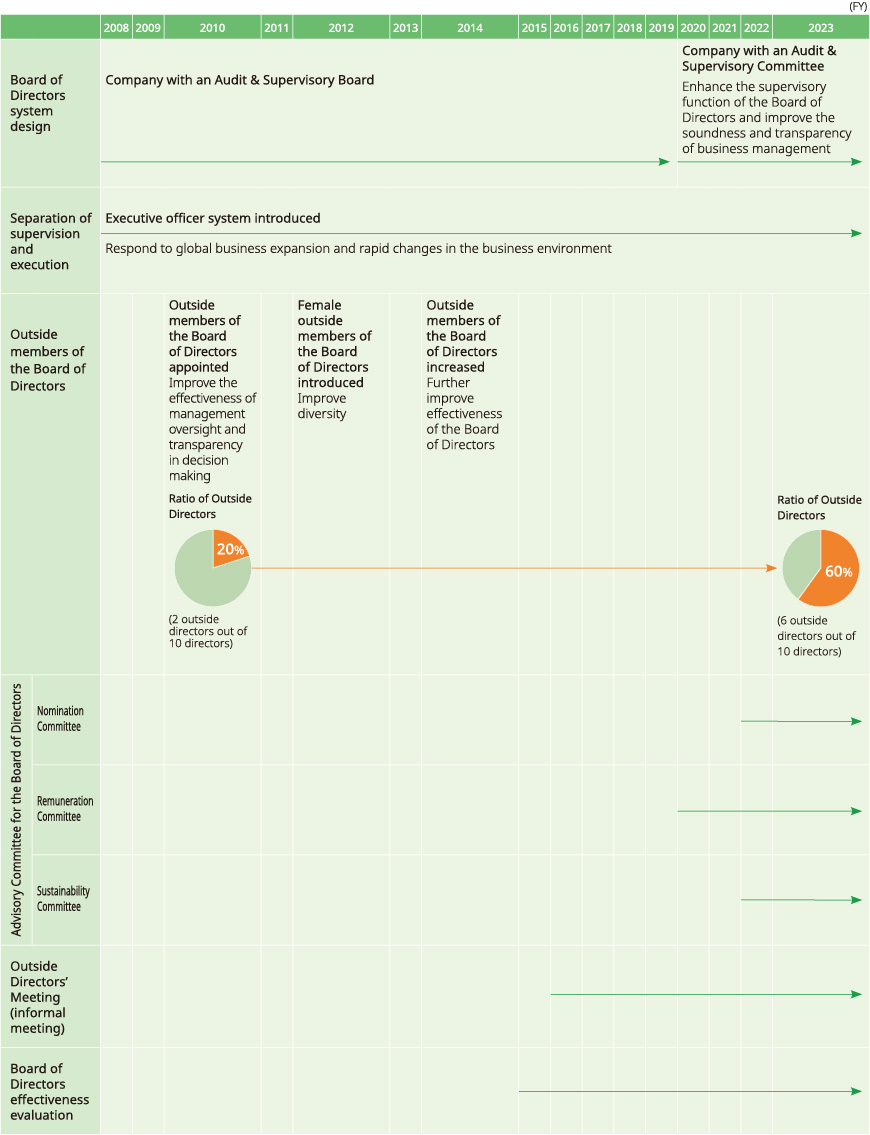

History of Nidec’s corporate governance

Corporate governance structure

Board of Directors

Nidec’s Board of Directors makes decisions on important business management matters, while supervising the execution of business operations. We have onboard people with no special relationship with the company and who are highly independent of it as Outside Directors, to enhance the supervisory function of the company’s business management, and its transparency and objectivity. Pursuant to the resolution from a meeting of the Regular General Meeting of Shareholders held in June 2024, the company’s Board of Directors comprises 11 members, 6 of whom are Outside Directors.

Attendance of the Board Directors to the meetings of the Board of Directors and individual committee meetings(FY2022)

| Member | Number of times of attendance / the meeting held (attendance rate) | ||||

|---|---|---|---|---|---|

| Meetings of the Board of Directors | Audit and Supervisory Committee | Nomination Committee | Remuneration Committee | Sustainability Committee | |

| Shigenobu Nagamori | 26/26 (100.0%) | - | 3/3 (100.0%) | 1/1 (100.0%) | - |

| Hiroshi Kobe | 20/21 (95.2%) | - | 3/3 (100.0%) | 0/0 | 3/3 (100.0%) |

| Kazuya Murakami | 26/26 (100.0%) | 14/14 (100.0%) | - | - | - |

| Hiroyuki Ochiai | 26/26 (100.0%) | 14/14 (100.0%) | - | - | 3/3 (100.0%) |

| Teiichi Sato | 17/21 (81.0%) | - | - | 0/0 | 0/0 |

| Yayoi Komatsu | 20/21 (95.2%) | - | 3/3 (100.0%) | - | - |

| Takako Sakai※2 | 24/26 (100.0%) | 4/4 (100.0%) | 3/3 (100.0%) | 1/1 (100.0%) | 3/3 (100.0%) |

| Aya Yamada | 24/26 (92.3%) | 14/14 (100.0%) | 3/3 (100.0%) | 0/0 | - |

| Tamame Akamatsu | 15/21 (71.4%) | 9/10 (100.0%) | - | - | 3/3 (100.0%) |

| Junko Watanabe | 11/13 (84.6%) | 5/5 (100.0%) | - | - | 2/2 (100.0%) |

- *1 The difference in the number times held is due to the difference in the timing of appointment.

- *2 Ms. Takako Sakai was elected as a Member of the Board of Directors and assumed office at the 49th Regular General Meeting of Shareholders held on June 17, 2022. She had previously served as a Member of the Board of Directors who is an Audit and Supervisory Committee Member, and her attendance shown includes the period of service as a Member of the Board of Directors who is an Audit and Supervisory Committee Member.

Themes of deliberations at the Board of Directors meetings

Effectiveness evaluation of the Board of Directors

Annually, Nidec sends out questionnaires to all members of the Board of Directors, including Outside Members, on the effectiveness of the Board of Directors’ meetings, and the Board of Directors discusses, analyzes and assesses the results of the questionnaires. Based on the results of the questionnaires, Nidec formulates measures for constant improvement.

Questionnaire survey on the effectiveness of the Board of Directors (efforts and evaluation)

Efforts made in FY2022 to ensure effectiveness

- Continued to provide explanation for outside members of the Board of Directors prior to Board meetings so that they can be provided with sufficient information on each item of the agenda and opportunities for discussion.

- Promoted understanding of our business by non-executive directors at informal meetings (explanation of business and online plant tours) and shared information obtained from investors and other stakeholders on a continuous basis.

- Provided information on investment projects by such means as explaining their relationships with the medium- to long-term strategic goals at the Board of Directors’ meetings.

- Disclosed a skills matrix at the time of director appointment, and explained the career background, skills, etc. of the persons appointed as executive directors or other responsible executive positions upon appointment.

FY2022 evaluation results

- In addition to the size, composition (ratio of internal and outside directors, diversity, etc.), meeting frequency and length, and the quality of information and explanation provided to Board members, the Board of Directors was highly evaluated in terms of the following points: “The Board functioned sufficiently on the whole,” “Board materials cover all necessary information,” and “The Board provides sufficient oversight to ensure that the development of potential management successors is carried out in a planned manner with sufficient time and resources given.”

- A third party (an outside law firm) also gave high marks to the effectiveness of the Board of Directors in general, including its composition and operation, and confirmed that a system has been established to facilitate fruitful discussions at Board of Directors’ meetings and that free, lively and fruitful discussions were actually taking place. In addition, the overall supervisory function of the Board of Directors was highly rated, and it was also confirmed that substantial discussions were conducted on issues such as sustainability, which has been increasingly recognized as an important management issue in recent years. This third-party evaluation system has been implemented since FY2021.

- As for issues, several respondents pointed out that Board of Directors’ meeting materials should be provided earlier, while others pointed out the need for deeper discussions on medium- to long-term management strategies and issues. Further improvements are considered necessary.

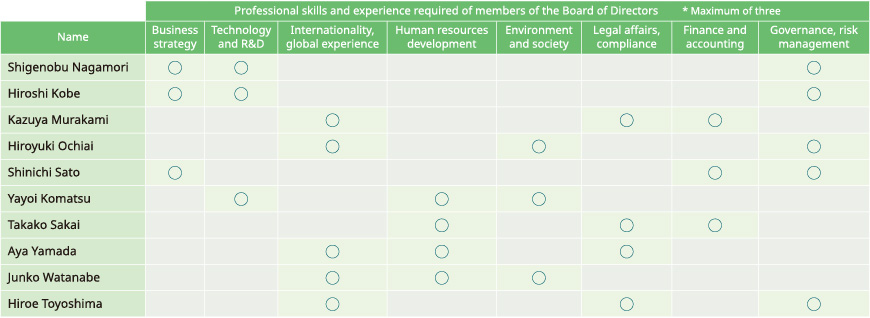

Skills matrix

Audit and Supervisory Committee

The Audit and Supervisory Committee audits the execution of duties by the Board of Directors’ members, and receives audit reports from the Accounting Auditor.

Composition of members and the chairperson

| Composition | |

|---|---|

| Total committee members | 5 |

| Full-time members | 2 |

| Internal Members of the Board of Directors | 2 |

| Outside Members of the Board of Directors | 3 |

| Chairperson | Internal Member of the Board of Directors |

Cooperation between the Audit and Supervisory Committee and accounting auditors

In addition to quarterly meetings, the Audit and Supervisory Committee and the accounting auditors meet about two or three times a year whenever necessary. In these meetings, they exchange information and opinions on audit results, audit systems, audit plans, audit implementation status and the like.

Cooperation between the Audit and Supervisory Committee and the internal audit department

The Corporate Administration & Internal Audit Department, Nidec’s internal audit department, regularly hold meetings with the Audit and Supervisory Committee to report on the results of the Nidec Group’s internal audits. In addition, the Audit and Supervisory Committee exchanges opinions and shares information with the Corporate Administration & Internal Audit Department as necessary, and requests the Corporate Administration & Internal Audit Department to conduct on-site audits.

Nomination Committee

The Nomination Committee is headed by Takako Sakai, an outside member of the Board of Directors, and consists of two internal members and three outside members of the Board of Directors. The Committee deliberates on the policy and criteria for the appointment of directors and executive officers, etc., as well as the succession plan and the approach to the succession plan, and the proposed candidates for executive vice presidents and president.

Remuneration Committee

The Remuneration Committee consists of two internal members and three outside members of the Board of Directors, headed by an outside member of Board of Directors as the chairperson. The Committee members discuss basic policies and systems for remunerations of directors in response to consultation from the Board of Directors, and reports the results back to the Board of Directors.

Sustainability Committee

The Sustainability Committee is headed by Takako Sakai, Outside Member of the Board of Directors and consists of two internal members and three outside members of the Board of Directors. It oversees business operations related to sustainability and reports to the Board of Directors. The Sustainability Committee meets once every quarter.

Various committees

| Name | Description |

|---|---|

| Information Security Committee | The Information Security Committee is placed under the Board of Directors to formulate basic policies concerning information security, as well as to monitor the status of implementation of various information security measures and provide instructions. |

| Compliance Committee | The Compliance Committee is placed under the Board of Directors to discuss and decide basic compliance policies and measures, as well as to monitor the status of implementation of various compliance measures and provide instructions for improvement. The Compliance Committee meets once every three months. |

| Risk Management Committee | The Risk Management Committee is placed under the Board of Directors and is headed by the person appointed by the Board of Directors as the chairperson, to decide risk management policies and measures, and submit reports and proposals to the Board of Directors. It also monitors the companywide risk management status and constantly reviews the adequacy of allocation of resources necessary for risk management. Based on the annual policies established by the Risk Management Committee, department general managers and Group companies formulate and carry out their respective annual risk management plans. |

Monthly Executive Meeting

The Monthly Executive Meeting is a meeting where the CEO and all the other executives gather to discuss high-priority issues to ensure that all executives share the same level of understanding on the Nidec Group’s direction.

Executive Management Meeting

The Executive Management Meeting, an organ to make decisions on business execution, is held twice in principle. Chaired by Nidec Corporation’s President, this meeting is held for its participants to deliberate in advance matters to be submitted to a meeting of the Board of Directors; discuss overall business execution policies and plans; and deliberate and resolve individual important matters.

Internal control system

We have Corporate Administration & Internal Audit Department audit individual business bases to maintain and improve the internal control in financial reporting in accordance with Article 24-4-4-1 of Japan’s Financial Instruments and Exchange Act.

Additionally, under our Board of Directors, we have in place a Compliance Committee, a Risk Management Committee, an Information Security Management Committee, and a CSR Committee, for each of which Legal & Compliance Department, Risk Management Office, Information Systems Department, and Sustainability Promotion Department serve as secretariats respectively, to build a corporate culture that promotes internal control, and reinforce its management system.

Nidec Group companies’ corporate governance

Nidec Group companies act based on the Nidec Corporation’s business philosophies and policies, and are part of the Nidec Corporation’s internal control system. Nidec Corporation dispatches and seconds its executives and employees to its consolidated subsidiaries. The companies respectively consider the opinions of experts and others, and discuss sufficiently before making executive decisions based on each company’s situation, to secure its independency.

*For more about Nidec’s corporate governance and internal control systems, see the Corporate Governance page.

Cross-shareholding

Policy for cross-shareholding

Nidec holds shares in the companies that Nidec has relationships with in terms of trading and cooperation in its business and other areas, when it judges that such shareholding contributes to the company’s corporate value expansion through stabilization of its business from a medium-to-long-term perspective by maintaining and strengthening its relationship with those companies. Nidec assesses its cross-held shares individually at the Board of Directors meeting every year, on not only qualitative aspects such as the purpose of the shareholding, but also on quantitative aspects such as the benefits that can accrue through the shareholding from the perspective of economic rationality. According to the results of the assessment, Nidec intends to reduce the number of shares it holds if the cross-held shares are not expected to bring significant benefits.

Criteria for exercising voting rights for cross-shareholding

With regard to the exercise of voting rights in relation to cross-shareholdings, Nidec makes comprehensive decisions to vote for or against individual proposals to serve the investees’ sustainable growth from the perspective of whether appropriate governance and compliance structures are in place at investee companies.

Basic views on exercising voting rights

With regard to the individual proposals submitted to the shareholders’ meetings of the companies Nidec invests in, Nidec decides to vote for or against after confirming the following points: whether the proposals suit the purposes of the shareholding which are to maintain and strengthen the trade and cooperation relationships through medium-to-long- term investment; and particularly, whether there are any circumstances that might lead to undermining of the shareholders’ value due to the restructuring of organizations, including asset transfer and mergers. Nidec opposes all proposals that are considered to violate the law or constitute antisocial behavior, in all circumstances.

*For more about Nidec’s corporate governance and internal control systems, see the Corporate Governance page.