G/Governance

Remuneration

Policies on remuneration for Members of the Board of Directors

Basic policy

The remuneration for Nidec’s directors is determined based on the following policy, to enhance the company’s global competitiveness and secure the sustainable growth of its businesses.

- Increase motivation toward improving corporate value

- Contribute to securing talented managerial human resources

- Ensure that the level of the remuneration is appropriate for the scale and area of Nidec’s businesses

Composition of the remuneration

- Outside Members of the Board of Directors (excluding those who are members of the Audit and Supervisory Committee)

Fixed remuneration - Members of the Board of Directors (excluding those who are Outside Members of the Board of Directors and members of the Audit and Supervisory Committee)

Fixed remuneration : Variable remuneration (bonuses) : Performance-linked share-based remuneration

= 3 : 1.5 : 1

Procedure to decide the remuneration amounts

The amounts of fixed and variable remunerations for individual directors (excluding members of the Board of Directors who are members of the Audit and Supervisory Committee) are determined by the Board of Directors based on reports submitted by the Remuneration Committee, which is a voluntary advisory body, in accordance with the criteria specified by this policy. Similarly, the details of the performance-linked share-based remuneration are determined by the Board of Directors based on reports submitted by the Remuneration Committee.

Forfeiture, etc. of remuneration (clawback/malus)

The amounts of fixed and variable remunerations may be reduced if the recipient has caused serious damage to the company by obtaining the consent of the recipient. Based on the performance-linked share-based compensation plan, if any individual to be issued shares should, on or after the day when his/her right to receive compensation is finalized, commit an illegal action such as a material violation of his/her duties or internal rules/regulations, the company may request that the individual pay restitution.

Total amount of remuneration by category of directors and by type of remuneration, and the number of eligible directors

*1 The above performance-linked remuneration includes the amount paid to two members of the Board of Directors who resigned during the 48th period and one member of the Board of Directors who resigned during the 50th.

*2 The introduction of the performance-linked share-based remuneration system was resolved at the 45th Annual General Meeting of Shareholders held on June 20, 2018. The amounts of expenses recorded for the fiscal year under review according to the Japanese standard are provided above. Outside members of the Board of Directors are not covered by the system.

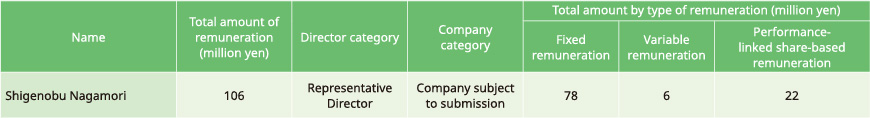

Total amount of consolidated remuneration, etc. of each director

* Only directors whose total amount of remuneration is 100 million yen or more are presented.